London Interbank Offered Rate (LIBOR) is the benchmark interest rate at which major global banks lend to one another. In 2017, regulators planned to phase it out after the traders manipulated rates for their profit. However, the plans were declined until 2023 at least, so for now, LIBOR still has a huge impact on the financial lives of thousands of Americans.

Table of Contents

The Meaning of LIBOR for a Trading Market

When LIBOR rates increase, consumers of loans discover their monthly payments went up. As a result, people borrow money online for their monthly payments and their debt is increasing. When the rates decline, (as they did during the COVID-19 pandemic), the borrowers will spot a whole different picture.

LIBOR index was established by the British Bankers’ Association in 1984, which administered it until 2014. For a long time, it was based on the rate that international bankers charge one another for loans.

The International Exchange still administers LIBOR asking a panel of banks the following question:

“At what rate could you borrow funds, were you to do so by asking for and then accepting interbank offers in a reasonable market size just before 11 a.m. London time?”

Most of the mortgage lenders look at the six-month and the one-year LIBOR for ARM loans.

Is There a Replacement for LIBOR?

The United States has to move from LIBOR to a different reference interest rate. The transition should be as smooth as possible; that’s why the Federal Reserve Board and the New York Fed formed the Alternative Reference Rates Committee (ARRC) in 2014. Their main mission was defined as exploring the interest rate that would replace LIBOR.

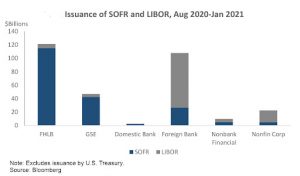

According to the ARRC investigation, the best and more resilient rate instead of LIBOR is the Secured Overnight Financing Rate (SOFR). It is produced by the New York Fed and published each business day; moreover, SOFR is based on actual lending transactions rather than the rates financial institutions say they would offer funds to each other.

Looking at all the changes coming onto the financial market in the U.S., we should say, the new interest rate should become more transparent. The SOFR will better reflect the rate financial institutions use to borrow money; plus, it represents the cost of overnight borrowing collateralized by the U.S. Treasury securities.

The Reasons for LIBOR to Phase Out

After years of the Great Recession (from 2007 to 2009), many banks reported different interest rates contrary to those they used. The general directors manipulated LIBOR for their reasons, leading to a major financial scandal.

As a result, LIBOR lost its credibility as the transactions decreased. In 2017, the U.K.’s Financial Conduct Authority decided that LIBOR should be phased out, but since then the process has been delayed.

The Ways LIBOR Affects Loans

As a regular bank customer, you might think that LIBOR won’t affect your credit card debt. However, it’s one of the breaking factors deciding which rates the bank will use for its loan products. Let’s take a look at different types of loans and the pitfalls of the Interbank Offered Rate.

Adjustable-Rate Mortgage (ARM)

With this type of loan, you lock in an interest rate, typically a low one, for a fixed period. By the end of this period, the mortgage resets to the current interest rate by default.

LIBOR influences your monthly payments directly: if it goes down during mortgage reset, your payments decrease; if it goes up — you know the rest. For people with a large income who never count monthly payments, it may not be a big deal; however, when your every paycheck depends on a payment, it will be hard to adjust.

Home Equity Line of Credits (HELOCs)

HELOC is a revolving debt: you can request a loan and then fulfill your credit limit during a draw period (like a credit card). You’ll feel the impact of LIBOR shifts in case you have an adjustable-rate credit.

During the draw period, HELOCs usually have interest-only payments. Borrowers may have a very low minimum monthly payment when LIBOR is low but then see it increase when LIBOR increases.

Student Loans

This type of borrowing will depend on LIBOR if it’s not backed up by the federal government. If you have a variable-rate student loan, your monthly payments will shift following the LIBOR shifts.

The LIBOR logic is pretty simple: however people make the same mistakes applying for a mortgage or student loans. Understanding the way it works, you can be a much wiser borrower counting your credit and finance charges.

Personal Loans

A personal loan is an unsecured debt, therefore, it’s highly dependable on LIBOR and any other interest rate. People apply for the loans like this to consolidate high-interest debt or make a large purchase. Normally, personal loans come with a fixed rate, but some of them are variable-rate loans.

The last type of loan is a variable-rate loan: it can be attractive when interest rates are especially low. In this case, you have lower monthly payments and have an opportunity to repay the debt quickly.

Wrapping up

LIBOR is the benchmark for financial institutions to use in a credit process. It is expected to be phased out and replaced by SOFR shortly. However, you have to consider it, especially when dealing with personal loans.

LIBOR had been one of the decisive financial factors for almost four decades. It affects all types of loans; so, even if you’re not a rich person and just need to pay the mortgage, you’re in the game. The higher LIBOR is on the economic market, the higher your interest rate will be.

As soon as the LIBOR stops working, it’s assumed to be replaced by SFOR. Many experts believe it’s going to be more transparent and resilient than LIBOR. We don’t know for sure if it’s for the best for regular borrowers, but you can expect the interest rates to continue to trend with the market overall.